nj property tax relief for veterans

Both Veterans and Senior Citizens. Own the property.

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Reservists and National Guard personnel must be called to active duty service to qualify.

. Military Personnel Veterans. With respect to the 250 Veterans Property Tax Deduction the petax year is October 1 2020 with the deduction applied to the property taxes for calendar Year 2021. Effective December 4 2020 State law PL.

413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax Exemption. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. Effective December 4 2020 State law PL.

The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. This article will go over all NJ property tax relief programs and recommend a personalized guide to help you.

The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. Under certain conditions combined deductions may be allowed ie. Veterans must have active duty service with an honorable discharge.

NJs wartime military veterans who own a home can receive a 250 deduction in property taxes. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service.

Reservists and National Guard personnel must be called to active duty service to qualify. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax. Veterans must have active duty military service with an honorable discharge.

More veterans can get help with property taxes New Jersey voters say. Only honorably discharged wartime veterans have been. If you are an.

Active Military Service Property Tax Deferment. Reservists and National Guard personnel must be called to active duty service to qualify. 6000 Veteran Income Tax Exemption Military veterans who were honorably discharged or released under honorable circumstances are eligible for a 6000 exemption on New Jersey Income Tax returns.

413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction. Voters are being asked whether more vets should be eligible. The ballot question which passed with 76 of the vote makes veterans eligible for a 250 property tax deduction regardless of whether they served during a time of war or peace.

Active duty for training continues to be ineligible. To file an application by phone1-877-658-2972. Tax deductions exemption and deferment programs include.

New Jersey voters gave a resounding yes to expand property tax benefits for veterans in last weeks election. Be a legal resident of New Jersey. However the total of all property tax relief benefits that you receive for 2021 Senior Freeze Homestead Benefit Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the amount of your 2021 property taxes or rentsite fees constituting property taxes.

It also expands a property tax exemption to include totally. More than 57000 veterans will soon be eligible for help paying their property taxes after New Jersey voters on Tuesday appeared to overwhelmingly support a change to. The OLS has estimated more than 4000 New Jersey peacetime veterans would qualify for the exemption if voters approved.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care retirement community CCRC. About the Company Property Tax Relief For Veterans In Nj CuraDebt is a company that provides debt relief from Hollywood Florida.

NJs wartime military veterans who own a home can receive a 250 deduction in property taxes. An 100 percent disabled veteran will receive a full property tax exemption. More than 53000 peacetime veterans will become newly eligible for a 250 property tax deduction in keeping with a 2020 voter referendum.

To qualify as of October 1 of the pretax year you must. If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions which reduce your property tax liability by 250. A payment or a credit will be made by the CCRC to the claimant within 30 days after the CCRC receives its credited property tax bill.

TRENTON Governor Murphy today signed legislation S-278 S-956 and S-961 which supports New Jersey veterans and servicemembers and grants them easier access to higher education expands access to the disabled veterans property tax exemption and establishes an annual grant program within the Troops to College Program to recognize. Property Tax Exemption for Disabled Veterans. Public Law 2019 chapter 413 became operative when New Jersey voters approved a Constitutional Amendment effective December 4 2020 to eliminate the wartime service requirement for both the 250 Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption.

Property tax relief comes in different shapes and forms in New Jerseyit can be a tax freeze a deduction or a benefit programNJ also provides various property tax exemptions you can apply for to lower your taxes. Active Military Service Property Tax Deferment. 250 Veteran Property Tax Deduction.

100 Disabled Veteran Property Tax Exemption. About the Company Property Tax Relief For Veterans In Nj CuraDebt is a company that provides debt relief from Hollywood Florida. The Homestead Benefit program provides property tax relief to eligible homeowners.

NJ Property Tax ReliefA Relief for Your Wallet.

Disabled Veterans Property Tax Exemptions By State

Senior Citizens Veteran S Deductions Edgewater Borough Nj Official Website

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

New Jersey Military And Veterans Benefits The Official Army Benefits Website

Freehold Township Sample Tax Bill And Explanation

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

New Jersey Military And Veterans Benefits The Official Army Benefits Website

Tax Assessor Chester Township Nj

Disabled Veterans Property Tax Exemptions By State

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

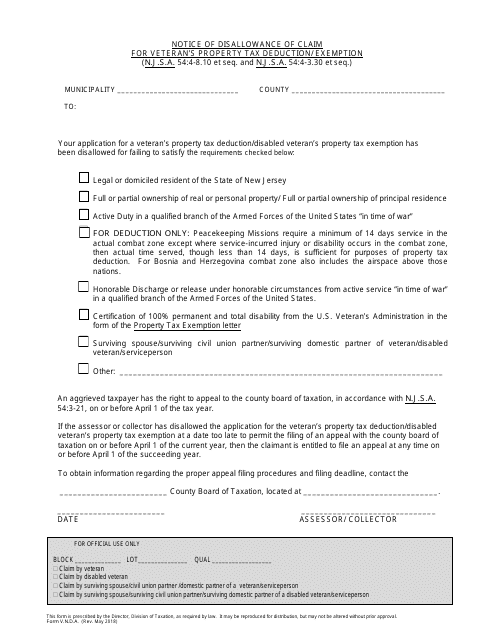

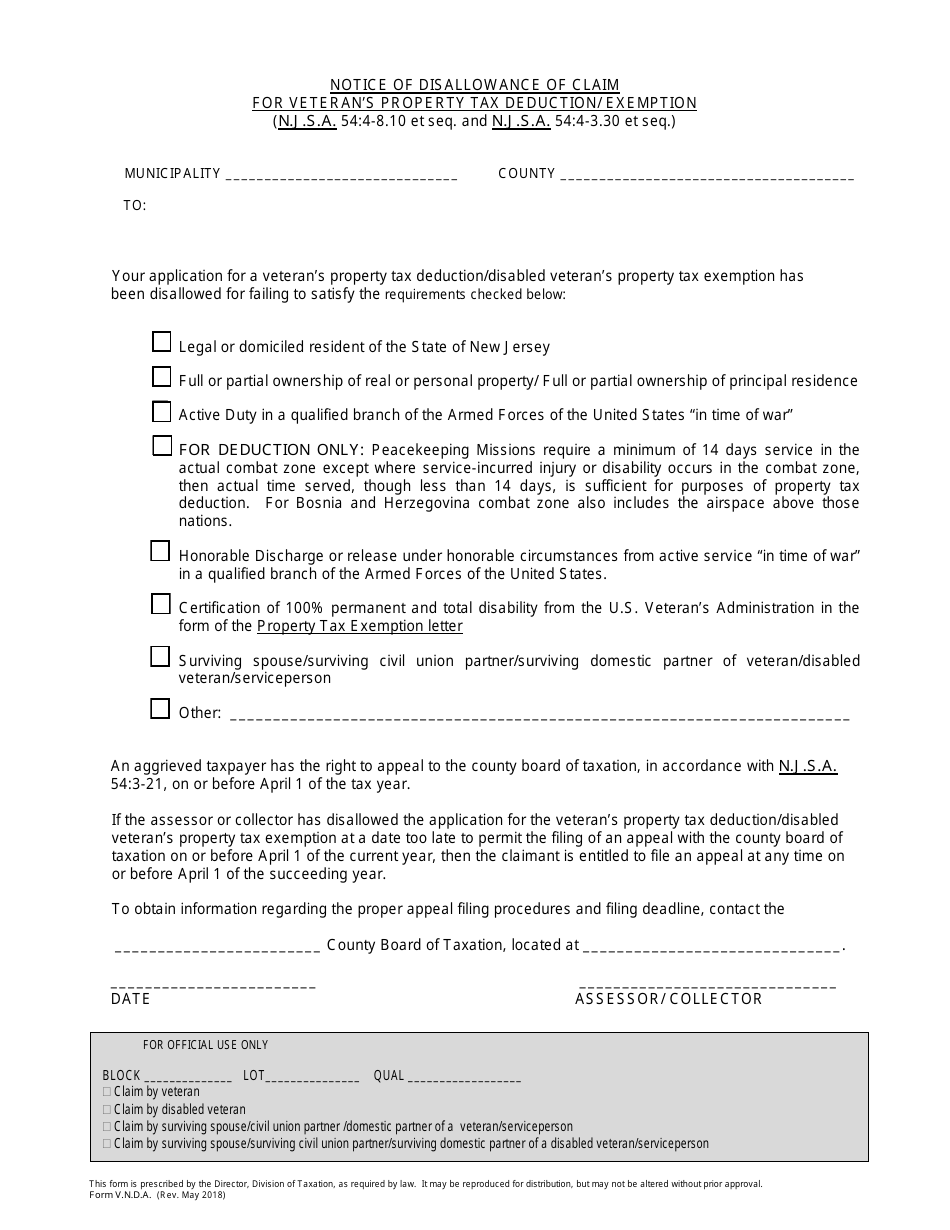

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

Freehold Township Sample Tax Bill And Explanation

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller